Cash App: A Comprehensive Guide for Users

Cash App is a popular mobile payment service that has gained a significant following over the years. Whether you’re looking to send money to friends, pay bills, or invest in stocks, Cash App offers a range of features that cater to your financial needs. In this detailed guide, we’ll explore the various aspects of Cash App, from its registration process to its unique features and benefits.

How to Register for Cash App

Registering for Cash App is a straightforward process. Here’s a step-by-step guide to help you get started:

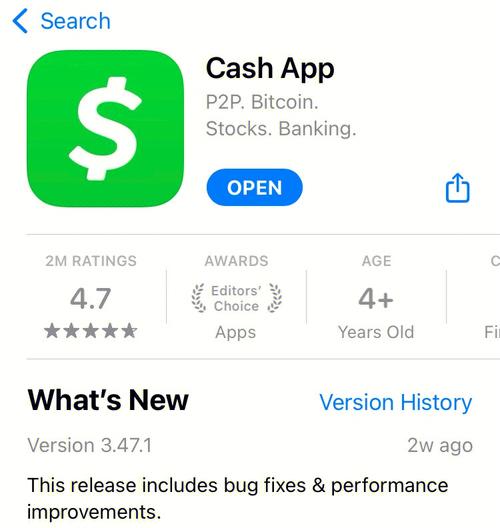

- Download the Cash App from the App Store or Google Play Store.

- Open the app and tap “Sign Up.” Enter your phone number and tap “Next.”

- Enter the verification code sent to your phone and tap “Next.”

- Set up your profile by entering your name, email address, and birthday.

- Link your bank account or debit card to the app.

Once you’ve completed these steps, you’ll have a Cash App account and can start using its features.

How to Send and Receive Money

One of the primary uses of Cash App is to send and receive money. Here’s how you can do it:

- Open the Cash App and tap the dollar sign icon.

- Enter the amount you want to send or receive.

- Enter the recipient’s phone number or email address.

- Tap “Pay” or “Request” to send or receive the money.

Cash App also allows you to send money using a recipient’s $Cashtag. Simply enter the $Cashtag in the recipient field, and the money will be sent to the corresponding account.

Using Cash App to Pay Bills

Cash App makes it easy to pay your bills directly from the app. Here’s how to do it:

- Tap the “Bills” tab at the bottom of the screen.

- Select the bill you want to pay.

- Enter the amount and payment date.

- Link your bank account or debit card to the app.

- Tap “Pay Now” to complete the transaction.

Cash App supports a wide range of bills, including utilities, phone, and internet services. You can even set up recurring payments for regular bills.

Investing in Stocks with Cash App

In addition to its primary functions, Cash App also allows you to invest in stocks. Here’s how to get started:

- Tap the “Invest” tab at the bottom of the screen.

- Enter the amount you want to invest.

- Select the stock you want to invest in.

- Review the investment details and tap “Invest Now” to complete the transaction.

Cash App offers a range of stocks to choose from, and you can easily track your investments within the app.

Security and Privacy

Security and privacy are top priorities for Cash App. Here are some of the features that help protect your account:

- Two-factor authentication: This adds an extra layer of security to your account.

- Biometric authentication: You can use your fingerprint or face ID to access your account.

- 24/7 monitoring: Cash App monitors your account for suspicious activity and alerts you if any issues are detected.

Additionally, Cash App uses encryption to protect your personal and financial information.

Customer Support

Cash App offers customer support through various channels:

- Email: You can send an email to support@cashapp.com.

- Phone: Call 1-833-647-2672 for assistance.

- Chat: Use the chat feature within the app to get help from a customer support representative.

Cash App’s customer support team is available 24/7 to help you with any issues you may encounter.

Conclusion

Cash App is a versatile mobile payment service that offers a range of features to help you manage your finances. From sending and receiving