Cash App Bank Information: A Comprehensive Guide

Cash App, a popular mobile payment service, has revolutionized the way people manage their finances. One of its key features is the ability to link a bank account, which allows users to easily transfer money, receive payments, and make purchases. In this article, we will delve into the details of Cash App bank information, covering everything from account linking to security measures. Let’s get started.

How to Link Your Bank Account to Cash App

Linking your bank account to Cash App is a straightforward process. Here’s a step-by-step guide to help you get started:

- Open the Cash App on your smartphone.

- Tap on the “Bank” tab at the bottom of the screen.

- Choose “Link Bank” from the options.

- Enter your bank account details, including your routing number and account number.

- Follow the prompts to verify your account.

- Once verified, your bank account will be linked to Cash App.

It’s important to note that Cash App supports most major banks in the United States. However, some banks may not be compatible with the app. If you encounter any issues while linking your account, you can contact Cash App customer support for assistance.

Understanding Your Bank Information on Cash App

Once your bank account is linked to Cash App, you can view and manage your bank information from within the app. Here’s what you can expect:

- Account Balance: You can view the current balance of your linked bank account directly in the Cash App.

- Transaction History: The app provides a detailed transaction history, allowing you to track your spending and income.

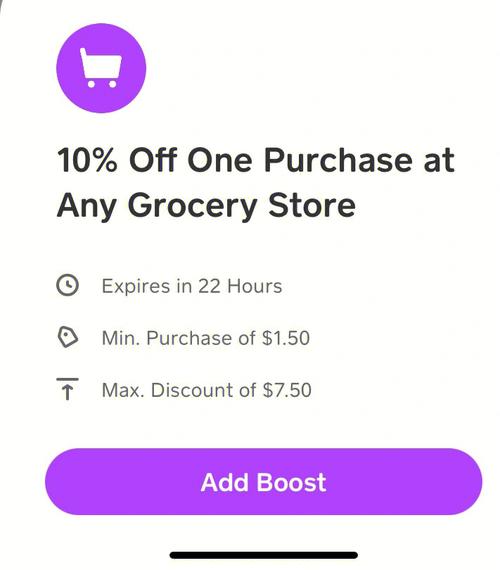

- Direct Deposit: You can set up direct deposit for your paycheck or other recurring income directly into your Cash App account.

- Bank Transfers: You can easily transfer money between your Cash App account and your linked bank account.

It’s important to keep your bank information up to date in the Cash App to ensure accurate transactions and prevent any potential issues.

Security Measures for Your Cash App Bank Information

Security is a top priority for Cash App, and the app employs several measures to protect your bank information:

- Two-Factor Authentication: To access your Cash App account, you must enter a unique code sent to your phone number or email address.

- End-to-End Encryption: All data transmitted between your device and Cash App’s servers is encrypted to prevent unauthorized access.

- Bank Account Masking: Your bank account number is masked in the app, displaying only the last four digits for privacy.

- Regular Security Updates: Cash App continuously updates its security protocols to protect against new threats.

Despite these measures, it’s still important to be cautious when using Cash App. Avoid sharing your login credentials or bank information with others, and report any suspicious activity to Cash App immediately.

Common Issues and Solutions

Like any financial service, Cash App may encounter issues from time to time. Here are some common problems and their solutions:

| Issue | Solution |

|---|---|

| Unable to link bank account | Ensure your bank is compatible with Cash App. If not, contact your bank or Cash App customer support. |

| Incorrect account balance | Check your bank account balance directly with your bank. If the issue persists, contact Cash App customer support. |

| Delayed transactions | Transactions can take up to 24 hours to process. If it’s been longer, contact Cash App customer support. |

| Suspicious activity | Report the activity to Cash App immediately. They will investigate and take appropriate action. |

Remember, Cash App customer support is available 24/7 to assist you with any issues you may encounter.