How Do You Overdraft on Cash App?

Overdrafting on Cash App can be a tricky situation, but understanding how it works can help you manage your finances more effectively. In this article, we’ll delve into the details of overdrafting on Cash App, including what it is, how it happens, and how to avoid it.

What is an Overdraft?

An overdraft occurs when you spend more money than you have in your account. This can happen with a checking account, a savings account, or even a credit card. When you overdraft, your bank or financial institution covers the difference, but you’ll be charged a fee and may be subject to additional penalties.

How Does Overdrafting on Cash App Work?

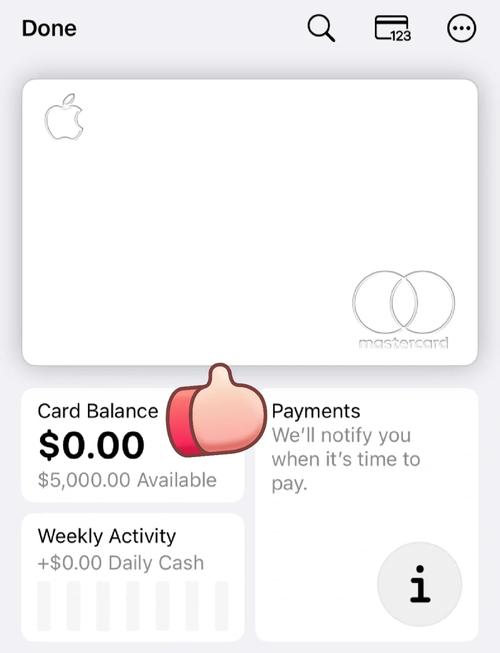

Cash App is a mobile payment service that allows users to send and receive money, pay bills, and invest. While Cash App doesn’t offer traditional overdraft protection like a bank, it does have a feature called “Cash Reserve” that can help you avoid overdrafting.

Here’s how it works:

-

When you set up a Cash Reserve, you link a bank account to your Cash App account.

-

When you try to make a payment that exceeds your available balance, Cash App will automatically transfer funds from your linked bank account to cover the transaction.

-

This transfer is subject to a fee, which varies depending on the amount transferred.

It’s important to note that Cash Reserve is not the same as overdraft protection. While it can help you avoid fees associated with overdrafting, it’s still possible to overdraft if you don’t have enough funds in your linked bank account.

How to Overdraft on Cash App

Here are a few ways you might accidentally overdraft on Cash App:

-

Spending more money than you have in your Cash App account.

-

Not having enough funds in your linked bank account to cover a Cash Reserve transfer.

-

Receiving a payment that exceeds your available balance.

Here’s an example:

| Transaction | Amount | Available Balance |

|---|---|---|

| Payment to friend | $50 | $30 |

| Cash Reserve transfer | $20 | $50 |

| Total | $70 | $50 |

In this example, you have $30 available in your Cash App account. If you try to make a payment of $50 to a friend, you’ll be charged a Cash Reserve fee and your linked bank account will be debited for the remaining $20. This will result in an overdraft of $10.

How to Avoid Overdrafting on Cash App

Here are some tips to help you avoid overdrafting on Cash App:

-

Keep track of your available balance.

-

Link a bank account with enough funds to cover your spending.

-

Use the Cash App budgeting tools to monitor your spending.

-

Set up alerts for low balance and transactions.

By following these tips, you can help ensure that you don’t accidentally overdraft on Cash App and avoid unnecessary fees and penalties.

Conclusion

Overdrafting on Cash App can be a costly mistake, but it’s important to understand how it works and how to avoid it. By keeping track of your available balance, linking a bank account with enough funds, and using the Cash App budgeting tools, you can help ensure that you never accidentally overdraft.