Can You Use Cash App Card at an ATM?

When it comes to managing your finances, having a reliable payment method is crucial. The Cash App card, issued by Square, Inc., has gained popularity for its ease of use and versatility. One common question among Cash App users is whether they can use their Cash App card at an ATM. Let’s delve into this topic and explore the various aspects of using the Cash App card at an ATM.

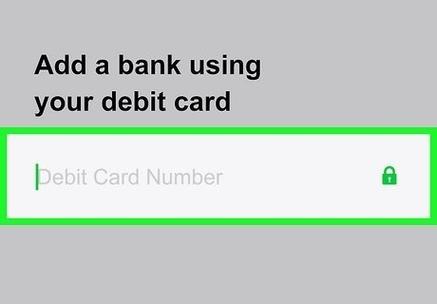

Understanding the Cash App Card

The Cash App card is a Visa debit card that allows you to make purchases, withdraw cash, and access your funds at ATMs. It is linked to your Cash App account, which you can fund using various methods, including direct deposit, bank transfers, and cash deposits at participating stores.

Using the Cash App Card at an ATM

Yes, you can use your Cash App card at an ATM. However, there are a few factors to consider before you head to the nearest ATM:

-

ATM Availability: While the Cash App card can be used at most ATMs, it is essential to check if the ATM supports Visa cards. Some ATMs may not accept the Cash App card, so it’s always a good idea to verify the ATM’s compatibility.

-

ATM Fees: When using your Cash App card at an ATM, you may incur fees. These fees can vary depending on the ATM owner and your Cash App account settings. It’s crucial to review your Cash App account’s fee structure to understand the potential costs.

-

Withdrawal Limits: The Cash App card has withdrawal limits, which can vary based on your account type and history. It’s important to be aware of these limits to avoid any surprises at the ATM.

How to Use the Cash App Card at an ATM

Using your Cash App card at an ATM is a straightforward process:

-

Insert your Cash App card into the ATM’s card reader.

-

Enter your PIN when prompted.

-

Select the “Withdraw Cash” option.

-

Enter the amount you wish to withdraw.

-

Follow the ATM’s instructions to complete the transaction.

Alternatives to Using the Cash App Card at an ATM

While using your Cash App card at an ATM is a convenient option, there are alternative methods to access your funds:

-

Cash Out at Stores: You can request a cash withdrawal from participating stores by using the “Cash Out” feature in the Cash App. This method is often free and provides a quick way to access your funds.

-

Direct Deposit: If you need to access your funds immediately, you can set up direct deposit from your Cash App account to your bank account.

-

Online Banking: You can transfer funds from your Cash App account to your bank account through online banking.

Conclusion

Using your Cash App card at an ATM is a viable option for accessing your funds, but it’s essential to be aware of the potential fees and withdrawal limits. By understanding the process and exploring alternative methods, you can make informed decisions about managing your finances with the Cash App card.

| ATM Feature | Description |

|---|---|

| ATM Availability | The Cash App card can be used at most ATMs that support Visa cards. However, it’s essential to verify the ATM’s compatibility before using it. |

| ATM Fees | When using your Cash App card at an ATM, you may incur fees, which can vary depending on the ATM owner and your Cash App account settings. |

| Withdrawal Limits | The Cash App card has withdrawal limits, which can vary based on your account type and history. It’s important to be aware of these limits to avoid any surprises at the ATM. |