How Much is a Cash App Card?

Are you considering getting a Cash App card? Do you want to know how much it costs? In this detailed guide, we’ll explore the various aspects of the Cash App card, including its price, features, and benefits. Let’s dive in!

Understanding the Cash App Card

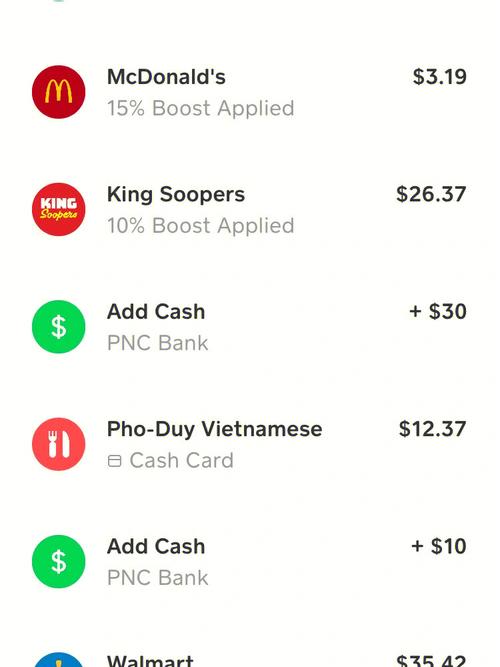

The Cash App card is a Visa debit card issued by Cash App, a mobile payment service. It allows users to make purchases, withdraw cash from ATMs, and receive direct deposits. Now, let’s discuss the cost of obtaining and using a Cash App card.

Cost of the Cash App Card

As of now, the Cash App card is free to obtain. You can request a card directly from the Cash App mobile app. Once you have the card, there are no monthly fees associated with it. However, there are a few other costs and fees you should be aware of:

| Fee Type | Amount |

|---|---|

| Monthly Fee | $0 |

| Card Replacement Fee | $5 |

| ATM Withdrawal Fee | $2.50 (if using an ATM not owned by Cash App) |

| International Transaction Fee | 3% |

As you can see, the Cash App card is generally cost-effective, especially when compared to traditional bank cards. However, it’s essential to keep in mind the fees associated with certain transactions, such as ATM withdrawals and international transactions.

Features and Benefits of the Cash App Card

While the Cash App card is free to obtain, it comes with several features and benefits that make it a valuable tool for managing your finances:

- Direct Deposits: You can receive your paycheck, tax refunds, and other payments directly to your Cash App account and card.

- Bill Pay: Pay your bills directly from the Cash App app, making it easier to manage your expenses.

- Peer-to-Peer Payments: Send and receive money from friends and family with ease.

- Spending Limits: Set spending limits to help you stay within your budget.

- Customizable Card Design: Choose from various designs to personalize your Cash App card.

These features and benefits make the Cash App card a versatile and convenient option for managing your finances.

How to Get a Cash App Card

Obtaining a Cash App card is a straightforward process:

- Download the Cash App from the App Store or Google Play Store.

- Open the app and sign up for an account.

- Enter your personal information and verify your identity.

- Request a Cash App card from the app.

- Wait for your card to arrive in the mail.

- Activate your card using the Cash App app.

Once your card is activated, you can start using it for purchases, withdrawals, and other transactions.

Conclusion

In conclusion, the Cash App card is a free and convenient option for managing your finances. While there are some fees associated with certain transactions, the card’s features and benefits make it a valuable tool for many users. If you’re looking for a simple and cost-effective way to manage your money, the Cash App card might be the right choice for you.