Does Cash App Have a Credit Card?

Are you considering using Cash App for your financial transactions, but you’re unsure if it offers a credit card? Well, you’ve come to the right place. In this detailed guide, I’ll delve into the question of whether Cash App has a credit card and explore various aspects of its services. Let’s get started.

Understanding Cash App

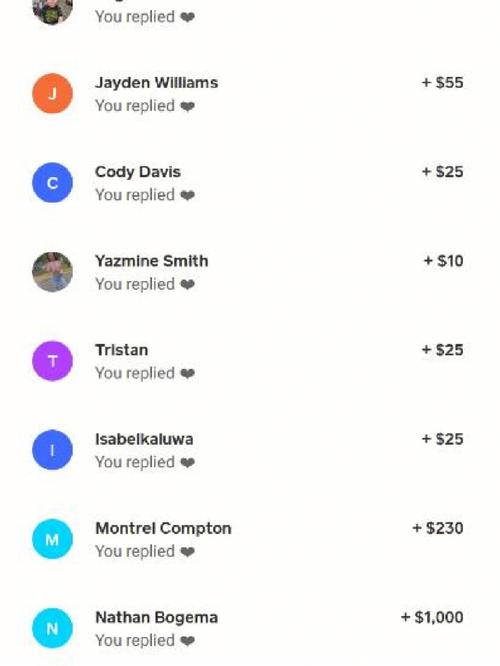

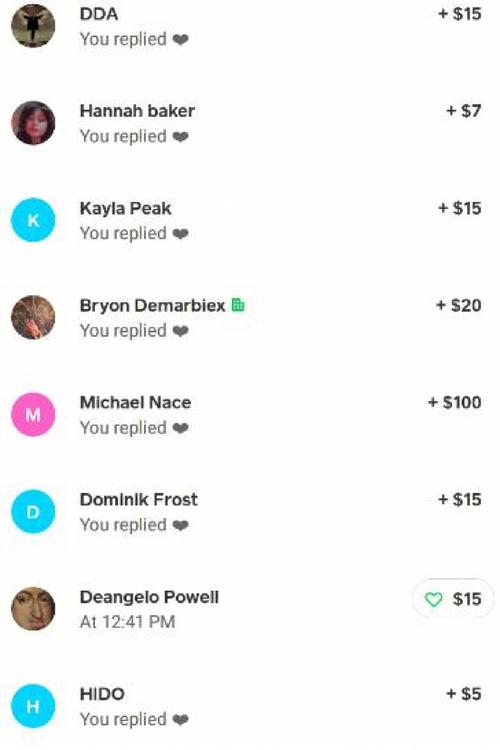

Cash App is a mobile payment service that allows users to send, receive, and store money. Launched in 2015 by Square, Inc., it has gained popularity for its user-friendly interface and convenient features. While Cash App is primarily known for its peer-to-peer money transfers, it offers a range of other services as well.

Does Cash App Have a Credit Card?

As of now, Cash App does not offer a traditional credit card. However, it does provide a Cash Card, which is essentially a virtual Visa card linked to your Cash App account. This card can be used for online purchases, in-store transactions, and ATM withdrawals. Let’s explore the Cash Card in more detail.

The Cash Card: A Virtual Visa Card

The Cash Card is a virtual Visa card that can be used for various transactions. Here are some key features of the Cash Card:

| Feature | Description |

|---|---|

| Virtual Card Number | Generated for online transactions |

| Physical Card Option | Available for in-store purchases and ATM withdrawals |

| Customizable Card Design | Users can choose from various designs |

| Spending Limits | Based on your Cash App account balance |

While the Cash Card is not a credit card, it offers many of the same benefits. Users can easily manage their spending, monitor transactions, and even set spending limits to avoid overspending.

Benefits of Using the Cash Card

Using the Cash Card with your Cash App account comes with several advantages:

-

Convenience: The Cash Card can be used for a wide range of transactions, making it easy to manage your finances on the go.

-

Security: The Cash Card is a virtual card, which means your actual account information is not shared during transactions.

-

Customizable: Users can choose from various card designs and set spending limits to suit their needs.

-

Integration: The Cash Card is seamlessly integrated with your Cash App account, allowing for easy money transfers and tracking.

Is a Cash Card the Same as a Credit Card?

No, a Cash Card is not the same as a credit card. Here’s a comparison of the two:

| Feature | Cash Card | Credit Card |

|---|---|---|

| Source of Funds | Linked to Cash App account balance | Line of credit from the issuing bank |

| Interest Rates | No interest charged | Interest rates may apply |

| Payment Terms | Payment due in full each month | Minimum payment required, with the option to carry a balance |

While the Cash Card offers many benefits, it’s important to understand that it is not a credit card and does not come with the same features or risks.

Conclusion

In conclusion, Cash App does not offer a traditional credit card, but it does provide a Cash Card that serves many of the same purposes. The Cash Card is a virtual Visa card linked to your Cash App account, offering convenience, security, and integration. While it may not be a credit card, it can be a valuable tool for managing your finances and making transactions.